An Initial Public Offering or首次公开募股is the very first sale of stock to the public by a private company. This is also known as 'going public'. There are two kinds of companies who will undertake an IPO:

- Startup companies looking to raise capital and investors

- Large private companies looking to become publicly traded

A company looking to conduct an首次公开募股will usually employ aninvestment bankto help with the首次公开募股, with the advisory service provided including valuation and timing. Investing in首次公开募股companies is usually risky as there is no historical data on the performance of the stock and the stock of newly public companies typically tends to fluctuate wildly after and on the首次公开募股date.

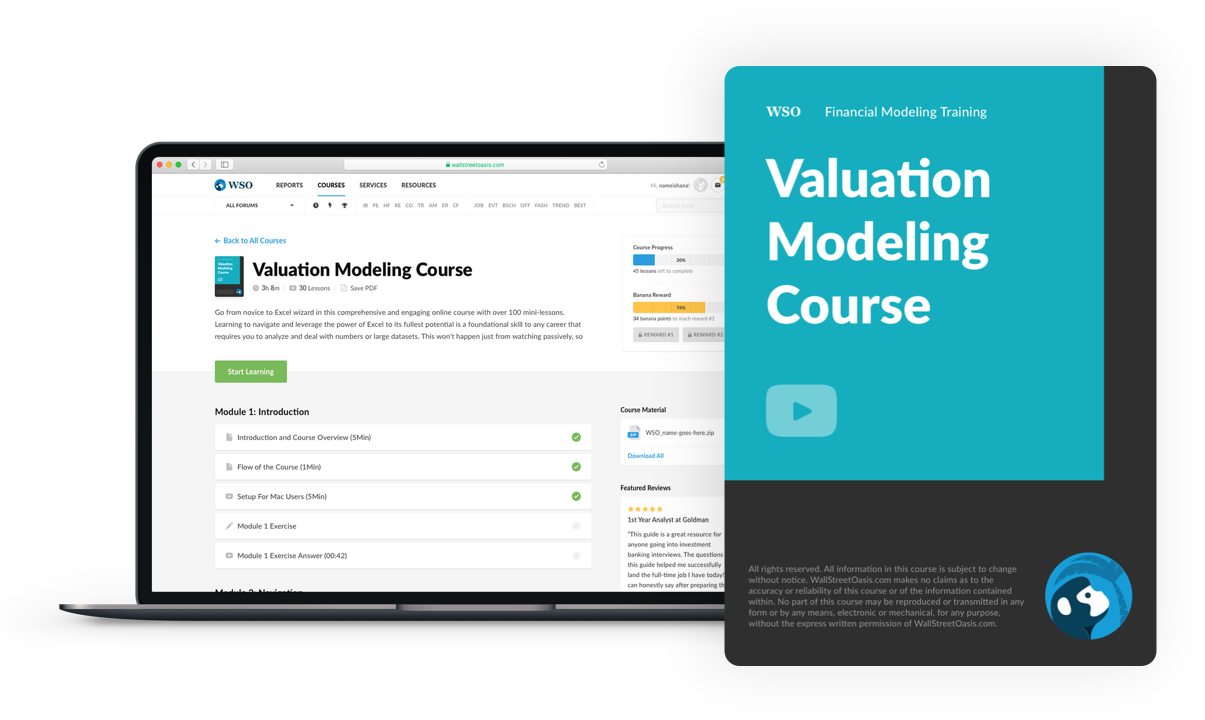

To learn more about this concept and become a master at valuation modeling, you should checkout our Valuation ModelingCourse.Learn more here.

国防部ule 1: Introduction

国防部ule 2: Valuation: The Big Picture

国防部ule 3: Enterprise Value &Equity Value Practice

国防部ule 4: Trading Comparables Introduction

国防部ule 5: Trading Comps: The Setup

国防部ule 6: Trading Comps: Spreading Nike (NKE)

国防部ule 7: Trading Comps: Spreading Adidas (ADS.DE)

国防部ule 8: Trading Comps: Spreading Lululemon (LULU)

国防部ule 9: Trading Comps: Spreading Under Armour (UA)

国防部ule 10: Trading Comps: Benchmarking and Outputs

国防部ule 11: Precedent Transactions: Introduction

国防部ule 12: Precedents: The Setup

国防部ule 13: Spreading Tiffany & LVMH

国防部ule 14: Spreading FitBit & Google

国防部ule 15: Spreading Reebok & Adidas

国防部ule 16: Spreading Jimmy Choo & Michael Kors

国防部ule 17: Spreading Dickies & VF

国防部ule 18: Valuation Wrap-Up

国防部ule 19: Bonus: Non-GAAP Practice

Related Terms

or Want toSign upwith your social account?