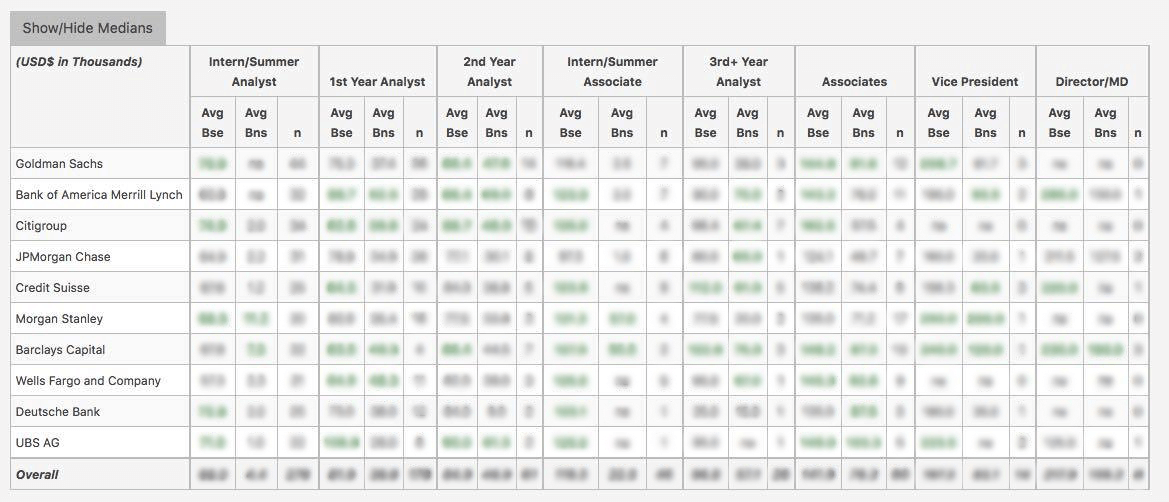

Investment Banking Compensation - As of December, 2022

Total Average Compensation - Bulge Bracket Banks(1) (2)

(1) Includes compensation data from the following investment banks: Bank of America Merrill Lynch, Barclays Capital, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley, UBS AG, Wells Fargo and Company

(2) Intern average compensation based on hourly rate x 2,000 to get yearly approximation

(2) Intern average compensation based on hourly rate x 2,000 to get yearly approximation

Get Full Access

或者Register to Contribute

公司有成千上万的面试问题

Yearly Trends - Investing Banking Pay By Position - Bulge Bracket Banks

包括以下投资银行的薪酬数据:美国银行美林林奇,巴克莱首都,花旗集团,瑞士信贷,德意志银行,戈德曼·萨克斯,摩根大通,摩根士丹利,摩根·史丹利,瑞银AG,富国银行,富国银行和公司

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Prepare for Your Investment Banking Interview

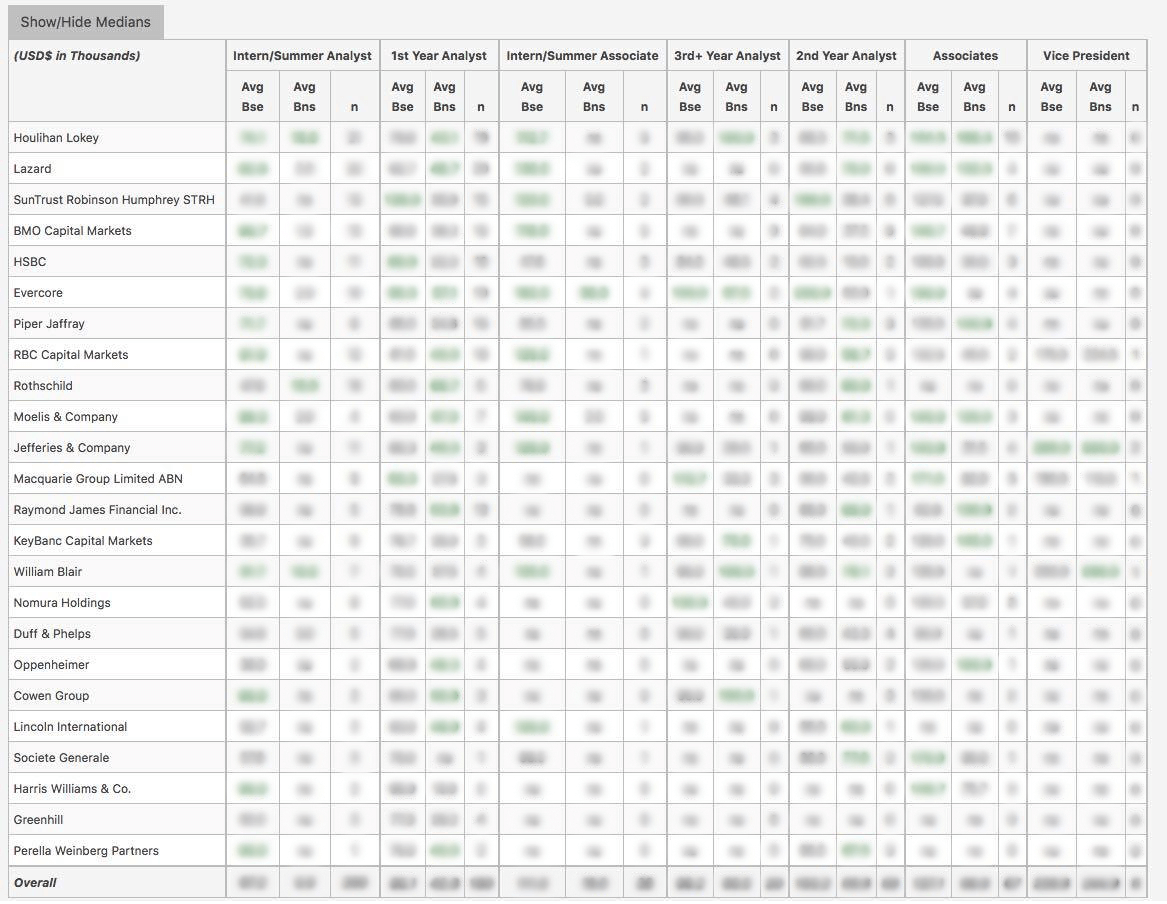

WSO Investment Banking Interview Course总平均薪酬 - 其他值得注意的银行(1) (2)

(1) Includes compensation data from the following investment banks: HSBC, BMO Capital Markets, Cowen Group, Duff & Phelps, Evercore, Greenhill, Harris Williams & Co., Houlihan Lokey, Blackstone Group, Jefferies & Company, Lazard, Moelis & Company, Nomura Holdings, Oppenheimer, Perella Weinberg Partners, Piper Jaffray, Raymond James Financial Inc., Rothschild, William Blair, Lincoln International, Macquarie Group Limited ABN, Société Générale, SunTrust Robinson Humphrey STRH, KeyBanc Capital Markets, RBC Capital Markets, PJT Partners

(2) Intern average compensation based on hourly rate x 2,000 to get yearly approximation

(2) Intern average compensation based on hourly rate x 2,000 to get yearly approximation

Get Full Access

或者Register to Contribute

公司有成千上万的面试问题

年度趋势 - 按职位投资银行支付 - 其他著名银行

Includes compensation data from the following investment banks: HSBC, BMO Capital Markets, Cowen Group, Duff & Phelps, Evercore, Greenhill, Harris Williams & Co., Houlihan Lokey, Blackstone Group, Jefferies & Company, Lazard, Moelis & Company, Nomura Holdings, Oppenheimer, Perella Weinberg Partners, Piper Jaffray, Raymond James Financial Inc., Rothschild, William Blair, Lincoln International, Macquarie Group Limited ABN, Société Générale, SunTrust Robinson Humphrey STRH, KeyBanc Capital Markets, RBC Capital Markets, PJT Partners

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

Get Full Access

或者Register to Contribute

公司有成千上万的面试问题

Methodology FAQ

How often is this data updated?

根据我们每天收集的其他数据,排名正在不断变化和发展。图和表使用YTD和前2年的数据。请参阅此页面上上面的选项卡以访问上一年的排名。

Why do the average compensation numbers look so low?

Remember that the compensation you are accustomed to hearing for top performers in the top groups in New York is well above the average for cities around the world. The compensation average graphs are a global average which includes regional cities and groups that bring the average down. If you would like company and group specific compensation data, please visit theWSO Company Database.

Where does this data come from?

The compensation, review and interview data comes from WSO member submissions to theWSO Company Database. With over 50,000 submissions to date across thousands of companies, the database is solely a representation of what our members were paid and how they rank companies on various metrics. Please see below for a detailed breakdown of the member statistics for those that have contributed to the database.

What are the percentile rankings based on?

The percentile rankings of companies listed here are based on the current YTD and the prior two years of data for companies that received at least one vote. The simple average scores are converted into an Adjusted Score before the companies are ranked to take into account companies with a smaller sample size. This method uses Bayesian Statistics.

Why do you use Bayesian Statistics to adjust scores?

This methodology is used in order to account for standard deviation in rankings. As a company gets more rankings and data, we have more confidence that the average ranking is a true reflection of reality, so this is reflected in the adjusted scores and Percentile rankings. Learn more about Bayesian Statistics这里.

我为什么看不到XYZ公司?

Some great smaller firms may not be represented in the rankings for the simple reason that we have not collected enough data to represent them accurately or for us to have enough data to display them at all.

What is the geographical representation of the submissions?

The WSO user base is very US-centric with approximately 70% of all submissions coming within the United States of America. Please see the detailed breakdown of the member statistics for those that have contributed to the database. For more company and city specific compensation, please visit theWSO Company Database.

或者Want toSign upwith your social account?